Our Everyday Checking Accounts

An everyday bank account with handy extras

Checking Accounts

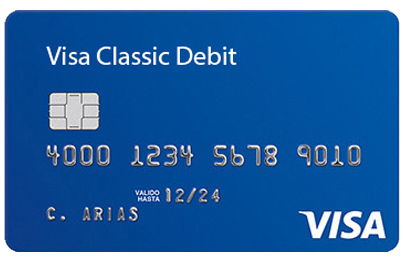

Ways to avoid Monthly Service Fees with RM250+ in Enhanced Direct Deposits

Switch your Checking Account in a simple, reliable and stress-free way in only 7 working days.

Apply for an Everyday Checking Account today:

Are you eligible?Things to remember before applying:

You can arrange an overdraft on your bank account, subject to your credit status. Use our overdraft calculator to understand how much interest you will pay when you use your overdraft. For full details of our overdraft rates and charges see our price list.

Enjoy the freedom to do more with an Zest Bank Credit Card or Personal Loan, subject to status.

The Checking Account Switch Service is simple, stress-free and supported by our dedicated switching team.

Choose how you want to bank either by online, mobile or telephone banking4. You can check your balance, pay bills or make payments to family and friends.

1. For Zest Bank customers only with Online Banking & iPhone, iOS 10 or above.

2. Apple and iPhone are trademarks of Apple Inc. registered in the U.S and other countries.

3. Using your Debit Card abroad: The exchange rate that applies to any foreign currency debit card payments (including cash withdrawals) is the Visa scheme exchange rate used by VISA on the day the conversion is made plus a Non-sterling transaction fee, which is currently 2.75% of the transaction amount (and for cash withdrawals a Cash Fee of 2% of the cash withdrawal (minimum: RM1.75, maximum: RM5)). We will make the conversion and deduct the payment from your account once we receive details of the payment from VISA, at the latest the next working day. Details of the current Visa scheme exchange rates are available at www.visaeurope.com.

4. Our telephone, online and mobile banking services are open 24 hours a day subject to scheduled maintenance periods. During busy periods calls may be transferred outside the United Arab Emirates. Textphone is not available in the Channel Islands and Isle of Man. To help us continually improve our service, and in the interests of security, we may monitor and/or record your calls with us.

Things to remember before applying:

Everyday Checking Account customers can book an appointment to apply in branch by calling .

From outside the United Arab Emirates .

You'll need to bring identification and proof of your address.

Find your nearest branchIt only takes a few minutes to apply online for a sole or joint Zest Bank Account.

Residents living outside the United Arab Emirates must apply in branch and all parties will need to be present.

Apply for a sole account Apply for a joint account