Way2Save Savings

Saving as you spend with Save As You Go® automatic transfers

Build your savings automatically - Start a savings habit – link your Way2Save Savings account to your Zestchecking account, then choose the automatic savings option that best fits your needs.

Account fees and details:

Monthly service fee: RM5

Avoid the monthly service fee with one of the following each fee period: - RM300 minimum daily balance

- 1 automatic transfer each fee period of RM25 or more from a linked Zestchecking account.

- 1 automatic transfer each business day within the fee period of RM1 or more from a linked Zestchecking account.

- 1 or more Save As You Go® transfers from a linked Zestchecking account.

- Primary account owner is 24 years old or under.

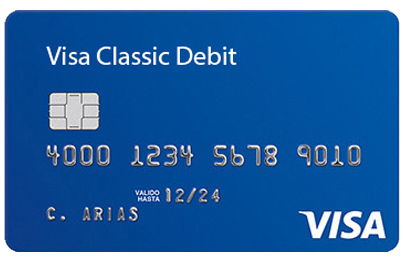

A qualifying Save As You Go transfer is an automatic transfer of RM1 from your linked Zestchecking account to your Way2Save Savings account each time you (or any authorized signer or joint owner) use your debit card for a one-time purchase or complete a Bill Pay transaction through online banking, and the one-time debit card purchase or Bill Pay transaction posts to the account. We reserve the right to determine through our sole discretion if a particular transaction is a qualifying transaction.

Overdraft Protection is not available for Clear Access Banking accounts.

You may pay an early withdrawal penalty or a Regulation D penalty if you withdraw funds from your account before the term is complete. Some exceptions may apply. Penalties could reduce earnings on this account. The Regulation D Penalty is seven days’ simple interest on the amount withdrawn and applies to:

- Withdrawals made within seven days of account opening including the day the account was opened.

- Withdrawals made during the grace period, when additional deposits are made during the grace period and the withdrawal exceeds the amount of the matured CD balance.

- Withdrawals within seven days of any prior withdrawal where the Bank's early withdrawal penalty is not applied.

Other than the Regulation D penalty described above, any money withdrawn from the CD before the end of its term will be subject to an early withdrawal penalty based on the length of the CD term. If your term is:

- Less than 90 days (or less than 3 months), the penalty is 1 month's interest,

- 90 to 365 days (or 3-12 months), the penalty is 3 months' interest,

- Over 12 months through 24 months, the penalty is 6 months' interest, or

- Over 24 months, the penalty is 12 months' interest.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

To be eligible for the Online bonus saver account you just need to be:

If you have an Zest Bank Checking Account or other savings account and you're registered for online banking, you can apply online in minutes.

Log on to applyIf you already have an Zest Bank Checking Account or savings account (excluding an ISA), you can register for online banking. Once you've received your security details, you'll be able to apply for and manage your savings account online.

Register for online bankingIf you’re liable to pay tax outside the United Arab Emirates, please apply at your local branch.

Before applying, please take the time to read the following documents. You may also want to save them for future reference.

If you would like to use your allowance for stocks and share as well as cash.

Find out how much you could borrow with a mortgage. Your home may be repossessed if you do not keep up repayments on your mortgage

Find out more about tax efficient savings and how to make the most of your ISA allowance.

You can save from RM1. For balances that exceed RM50,000 we'll pay a lower rate of interest. See our Interest Rates for current rates.

Please note that the maximum balance permitted is RM2 million.

You can access your Online Way2Save Savings Account via online banking only.

We will pay a variable rate of interest as well as bonus interest for any month when you don't make a withdrawal. Please note, no bonus interest will be paid in any month where a withdrawal is made. Interest is calculated daily and is paid monthly. See our Interest Rates for current rates.